Strategic Analysis definition

The strategic analysis includes both Internal and external analysis. To get a better understanding let's define both of them.

The internal analysis

Internal analysis is aimed to assess the business's tangible and intangible resources and assets, to see the overall business health. A company's internal analysis involves performing both financial and non-financial analyses.

The external analysis

The external analysis is aimed to examine all the factors in the external environment that may have an impact on business operations.

Mission, objectives and strategy

Firstly, the mission is the statement communicating how the vision can be achieved. Objectives are more defined milestones with timeliness guiding the company of how its goal along with vision and mission can be achieved. Strategies are defined ways of how a business is going to achieve its vision, mission and objectives. Strategies are formed through detailed internal and external strategic analyses.

The vision statement is formed to identify the desired future positioning of the business.

Types of strategic analysis

Let's take a look at an overview of different types of strategic analyses.

Internal analysis

The internal analysis includes Financial ratio analysis, Kaplan and Norton’s balanced scorecard model and Elkington’s Triple Bottom Line model.

Financial ratio analysis

First, businesses need to analyse their strategic positioning financially to see how well the business is doing in terms of its profit and budgeting. The financial ratio analysis is an effective method for businesses to analyse their financial performance. Financial ratio analysis includes assessing key elements such as:

Liquidity- Analysis of how capable the company is to pay off immediate debts using its current assets.

Profitability - Analysis of the company’s capability of making a profit from its offered goods or services.

Gearing - is calculated by using the ratio of long-term liabilities to capital employed. This shows how much the company's capital is funded by long-term liabilities.

Efficiency ratios - This ratio measures companies ability to use its assets and to manage its debts effectively.

Additional tools to analyse a business's financial performance include a balance sheet, which describes the organisation's financial position at a designated period, and an Income Statement, which shows the organization's income and expenditure at the selected period.

Kaplan and Norton’s balanced scorecard model

This model is used to measure how aligned the business activities are to the company’s vision and strategy. This model can be used to analyse a business from financial and non-financial perspectives regarding the company’s vision and strategy.

The four perspectives of the model are:

Financial: organisation’s financial performance.

Customer: customers' satisfaction regarding business products, services and overall business.

Internal processes: measures how efficient the business is regarding its internal functions.

Learning and growth: how capable the company is to retain its efficient employees and encourage innovations.

Elkington’s Triple Bottom Line model

Elkington’s Triple Bottom Line model focuses on factors with which a business can measure its performance. The factors mainly focus on measuring a business’s non-financial performance.

These factors include:

Profit - This performance measure is done by looking at the firm’s financial statements.

Planet - This measures a business’s performance regarding the company’s impact on the environment, in terms of emissions and use of sustainable resources.

People - This factor analyses a business’s performance in terms of being socially responsible. This can include benefiting society, such as treating employees well, paying them fair wages and participating in charitable activities.

It may be hard to measure the business’s performance regarding the social aspect (People) as it may be difficult to measure exactly the extent to which business has benefited society and is socially responsible.

Internal and External analysis

This includes the SWOT analysis, the first two elements of which are strengths and weaknesses and belong to internal analysis and the next two elements including opportunities and threats are part of the external business analysis.

SWOT analysis

SWOT analysis is used by businesses to examine their internal and external influences in regards to their cooperative strategies. The first two elements, strengths and weaknesses, are used for internal analysis regarding current business positioning. The following two elements, opportunities and threats, are the possible external influences on a company that may occur due to the changing environment.

| Strengths - These represent the current business situation in terms of what the company is good at.- These may include high brand recognition, good cash flow or a loyal customer base. | Weaknesses- These are the current things business is not so good at and these require further improvement. - Weakness may include weakened brand image due to a product safety scandal or high production costs. |

| Opportunities- These include analysis of the changes in the external environment that may bring business new opportunities.- One of the examples of opportunities can be expanding internationally to countries that have lower costs of production. | Threats- These include analysing how the changes in the external environment can have a negative impact on the organisation.- One of the examples are new competitors that increase the competitive environment in the market. |

External Analysis

The external analysis includes a competitive analysis called Porter's 5 Forces and a PESTLE analysis of the external environment.

Porter's 5 Forces

This analysis will assist businesses in strategic planning in the competitive environment and determine the business’s competitive strategy.

The 5 forces are:

Rivalry among existing competitors - The first force refers to identifying the existing competitors in the market and their competitiveness.

Threats of new entrants - The company should consider how easy and costly it is for competitors to enter the market. If the barriers of entry are low, this can be a disadvantage for the company. However, if the barriers to entry are high, the company has already established brand loyalty and high switching costs.

Threats of substitutes - If there are quite a few substitutes available for a company’s goods and services, it may be a threat to the company. However, if there are no close substitutes businesses will have the power to set prices and establish a loyal customer base.

Bargaining power of buyers - The company must consider the number of customers it has and their price sensitivity and ability to find substitutes.

Bargaining power of suppliers - The power of suppliers depends on the number of suppliers available. The fewer suppliers mean that the company has less power and more dependency on suppliers, which gives them the power to set the terms and increase prices. On the other hand, if there is a lot of availability of suppliers, the company has the power to choose and bargain for lower prices.

PESTLE Analysis

This analysis is used to examine the external environment that may have an impact on a business's operations. The main elements included in PESTLE analysis (with examples) are:

Political - tax, financial stability, changes in legislation.

Economic - economic growth or rates of employment.

Social - demographic influences or lifestyle factors.

Technological - technology innovations.

Legal - tax policies or employment laws.

Environmental - laws in regards to regulations of pollution.

Strategic analysis process

The strategic analysis process's main aim is to form a strategy and make strategic decisions. There are key steps involved in this process. First, the company must conduct internal analysis and examine the external environment surrounding the organisation. In addition, the strategic analysis must be made taking into consideration the business's mission and objectives.

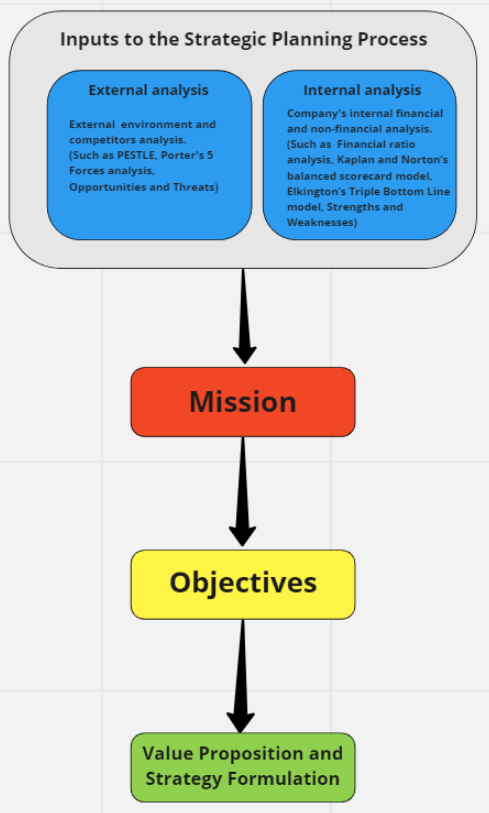

Strategic Analysis Process, StudySmarter

Strategic Analysis Process, StudySmarter

Inputs to the strategic planning process - As illustrated in the diagram above, the Strategic Analysis process starts with analysing a business's internal positioning using internal analyses such as financial ratio analysis and other non-financial analysis performance models. Additionally, the external environment is also a big part of the strategic analysis process.

Mission - Another component that must be involved in the business strategy analysis process is a mission statement. As mission defines reasons for business existence, business goals, values and culture.

For example, Apple’s mission statement is:

to bring the best personal computing products and support to students, educators, designers, scientists, engineers, businesspersons and consumers in over 140 countries around the world.”

This shows that Apple's ultimate goal is to create the best personal computers for people in 140 countries. Additionally, Apple's values are aimed towards equality and providing opportunities to people universally.

Objectives - Business objectives can differ between each other depending on their scale. For example, corporate objectives are set for the whole business usually by the top or senior-level management. These objectives do not focus on small details but rather look at the whole picture.

Value proposition and strategy formulation - A value proposition and strategic approach can be developed and business decisions can be made once the internal and external strategic analyses are complete and the company's mission and objectives are considered.

As part of a marketing strategy, the value proposition is the statement a business makes to the customer about the value they will receive when they purchase a product or service from them.

Strategic Analysis - Key takeaways

- The strategic analysis includes both Internal and external analysis.

- Internal analysis is aimed to assess the business's tangible and intangible resources and assets, to see the overall business health.

- External analysis is aimed at examining all the factors in the external environment that may have an impact on business operations.

- The key types of Internal business analysis are Financial ratio analysis, Kaplan and Norton’s balanced scorecard model and Elkington’s Triple Bottom Line model.

- SWOT analysis includes elements to conduct both Internal and External analysis. Internal analysis elements are strengths and weaknesses. The external analysis includes examining opportunities and weaknesses.

- The key types of external analysis include a competitive analysis called Porter's 5 Forces and a PESTLE analysis of the external environment.

- The key elements included in the Strategic analysis process are Inputs to the strategic planning process, mission, objectives, value proposition and strategy formulation.

SOURCES

1. Christine Rowland, Apple Inc.’s Mission Statement and Vision Statement (An Analysis), 2020

Learn with 508 Strategic Analysis flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Strategic Analysis

what are the types of strategic analysis?

Internal and external analysis are the types of strategic analysis.

what are the tools used for strategic analysis?

Financial ratios, Norton's balanced scorecard model, SWOT analysis, and PESTLE analysis are some tools used for strategic analysis.

why is strategic analysis important?

Strategic analysis help in devising strategies and in implementing them effectively.

What swot in strategic analysis?

A type of strategic analysis which is done internally.

S - Strength

W - Weaknesses

O - Opportunities

T - Threats

what are the processes in strategic analysis?

Inputs to the strategic planning process, mission, objectives, value proposition, and strategy formulation are the processes in strategic analysis.

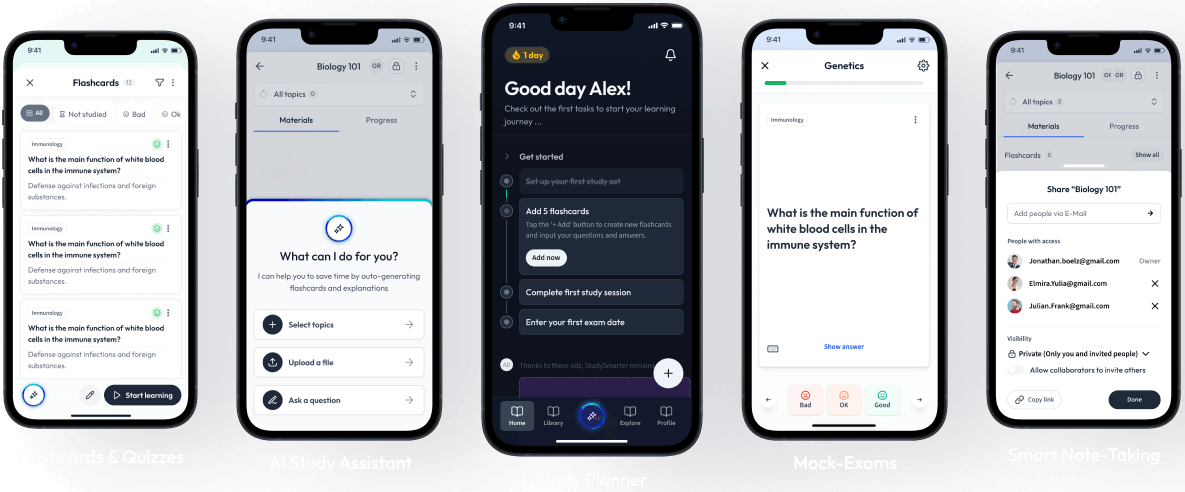

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more