Perfect Competition Definition

Perfect competition is a market structure in which there is a large number of firms and consumers. It turns out that the efficiency of a market can have a lot to do with the number of firms and consumers in that market. We can think of a market with only one seller (a monopoly) as being at one end of a spectrum of market structures, as illustrated in Figure 1. Perfect competition is at the other end of the spectrum, where there are so many firms and consumers that we might think of the number as being almost infinite.

However, there is a little more to it. Perfect competition is defined by several characteristics:

- A large number of buyers and sellers - there are seemingly infinitely many on both sides of the market

- Identical products - in other words, each firm's products are undifferentiated

- No market power - firms and consumers are "price takers," so they have no measurable impact on the market price

- No barriers to entry or exit - there are no setup costs for sellers entering the market and no disposal costs upon exit

Most real-life examples of competitive markets exhibit some, but not all, of these defining features. Everything other than perfect competition is called imperfect competition, which in contrast, includes the cases of monopolistic competition, oligopoly, monopoly, and everything in-between as shown in Figure 1 above.

Perfect competition occurs when there are a large number of buyers and sellers, all for an identical product. Sellers are price takers and have no control over the market. There are no barriers to entry or exit.

Perfect Competition Examples: Commodity Markets

Agricultural products, like corn, are traded on a commodity exchange. A commodity exchange is similar to a stock exchange, except that commodity trades represent a commitment to deliver tangible goods. Commodity markets are considered an example close to perfect competition. The number of participants buying or selling the same good on any given day is very, very large (seemingly infinite). The quality of the product can be assumed to be equal across all producers (perhaps due to strict government regulations), and everyone (both buyers and sellers) behave as "price takers." This means that they take the market price as given, and make profit-maximizing (or utility-maximizing) decisions based on the given market price. Producers have no market power to set a different price.

Graph of perfect competition: Profit maximization

Let's take a closer look by using a graph at how firms in perfect competition maximize their profits.

But before we look at a graph, let's remind ourselves about the general profit maximizing principles in perfect competition.

Firms in perfect competition maximize profit by choosing what quantity to produce in the current period. This is the short-run production decision. In perfect competition, each seller faces a demand curve for their product that is a horizontal line at the market price, because firms can sell any number of units at the market price.

Each additional unit sold generates marginal revenue (MR) and average revenue (AR) equal to the market price. Graph in Figure 2 below shows the horizontal demand curve facing the individual firm, denoted as Di at the market price PM.

Market Price in Perfect Competition: MR = Di = AR = P

We assume marginal cost (MC) is increasing. To maximize profit, the seller produces all units for which MR > MC, up to the point where MR = MC, and avoids producing any units for which MC > MR. That is, in perfect competition, the profit-maximizing rule for each seller is the quantity where P = MC.

The Profit-Maximization Rule is MR = MC. Under perfect competition, this becomes P = MC.

The optimal quantity is denoted by Qi in panel (a) in a graph in Figure 2. Because the profit-maximizing quantity for any given market price lies on the marginal cost curve, the section of the marginal cost curve that lies above the average variable cost curve is the individual firm's supply curve, Si. This section is drawn with a thicker line in panel (a) of Figure 2. If the market price falls below the firm's minimum average variable cost, then the profit-maximizing (or more precisely, loss-minimizing) quantity to produce is zero.

As long as the market price is above the firm's minimum average variable cost, the profit-maximizing quantity is where, on a graph, However, the firm makes a positive economic profit (illustrated by the green shaded area in panel (a) of Figure 2) only if the market price is above the firm's minimum average total cost (ATC).

If the market price lies between the minimum average variable cost (AVC) and minimum average total cost (ATC) on a graph, then the firm loses money. By producing, the firm gains revenue that not only covers all variable production costs, it also contributes to covering the fixed costs (even though not fully covering them). In this way, the optimal quantity is still where, on a graph, Producing the optimal number of units is the loss minimizing choice.

The Shutdown Rule is P < AVC.

If the market price lies below the firm's minimum average variable cost, then the profit-maximizing (or loss-minimizing) output is zero. That is, the firm is better off shutting down production. At a given market price in this range, no level of production can generate revenue that will cover the average variable cost of production.

Perfect Competition Market Power

Because there are so many firms and consumers in perfect competition, no individual players have any market power. That means firms cannot set their own price. Instead, they take the price from the market, and they can sell any number of units at the market price.

Market Power is a seller's ability to set their own price or influence the market price, thereby maximizing profit.

Consider what would happen if a firm in perfect competition raised its price above the market price. There are many, many firms producing an identical product, so consumers will not buy any units at the higher price, resulting in zero revenue. This is why the demand facing an individual firm is horizontal. All products are perfect substitutes, so demand is perfectly elastic.

Consider what would happen if this firm instead lowered its price. It can still sell any number of units, but now it is selling them at a lower price and making less profit. Because there are many, many consumers in perfect competition, this firm could have charged the market price and still sold any number of units (this is what the horizontal demand curve tells us). Thus, charging a lower price is not profit-maximizing.

For these reasons, perfectly competitive firms are "price takers," meaning that they take the market price as given, or unchangeable. Firms have no market power; they can only maximize profits by carefully choosing the optimal quantity to produce.

Perfect competition short run equilibrium

Let's take a closer look at the perfect competition short run equilibrium. Even though each individual seller in perfect competition faces a horizontal demand curve for their goods, the Law of Demand holds that market demand is downward sloping. As the market price decreases, consumers will shift away from other goods and consume more goods in this market.

Panel (b) of Figure 2 shows the demand and supply in this market. The supply curve comes from the sum of the quantities provided by individual firms at each price (just as the demand curve is the sum of quantities demanded by all individual consumers at each price). Where these lines intersect is the (short-run) equilibrium, which determines the price that is then "taken" by the firms and consumers in the perfectly competitive market.

By definition, in a perfectly competitive market, there are no barriers to entry or exit, and there is no market power. Thus, short-term equilibrium is allocatively efficient, meaning the market price is precisely equal to the marginal cost of productionThis means that the private marginal benefit of the last unit consumed equals the private marginal cost of the last unit produced.

Allocative efficiency is achieved when the private marginal cost of producing the last unit is equal to the private marginal benefit of consuming it. In other words,

In perfect competition, the market price publicly conveys information about the marginal producer and consumer. The information conveyed is exactly the information that firms and consumers need in order to be incentivized to act. In this way, the price system incentives economic activity that results in an allocatively efficient equilibrium.

Calculating profit in short-run equilibrium

Firms in perfect competition can make a profit or a loss in the short-run equilibrium. The amount of profit (or loss) depends on where the average variable cost curve lies in relation to the market price. To measure the seller's profit at Qi, use the fact that profit is the difference between total revenue and total costs.

Total revenue is given in panel (a) of Figure 2 by the area of the rectangle whose corners are PM, the point E, Qi and the origin O. The area of this rectangle is PM x Qi.

Because fixed costs are sunk in the short-run, the profit-maximizing quantity Qi relies only on variable costs (specifically, marginal cost). However, the formula for profit uses total costs (TC). Total costs include all variable costs and fixed costs, even if they are sunk. Thus, to measure the total costs, we find the average total cost at quantity Qi and multiply it by Qi.

The firm's profit is the green shaded square in Figure 2 panel (a). This method of calculating profit is summarized below.

How to calculate profit

Total cost = ATC x Qi (where ATC is measured at Qi)

Profit = TR - TC = (PM x Qi ) - (ATC x Qi) = Qi x (PM - ATC)

Long-Run Equilibrium in Perfect Competition

In the short run, perfectly competitive firms may make positive economic profit in equilibrium. In the long run, however, firms enter and exit this market until profits are driven to zero in equilibrium. That is, the long-run equilibrium market price under perfect competition is This is illustrated in Figure 3., where panel (a) shows the firm's profit maximization, and panel (b) shows the market equilibrium at the new price.

A normal profit is a zero economic profit, or breaking even after considering all economic costs.

To see how this price level results in zero profit, use the formula for profit:

Efficiency in long-run equilibrium

The short-run equilibrium in perfect competition is allocatively efficient. In the long run, a perfectly competitive equilibrium is both allocatively and productively efficient. Because free entry and exit drive profits to zero, the long-run equilibrium involves firms producing at the lowest possible cost - the minimum average total cost.

Productive efficiency is when the market is producing a good at the lowest possible cost of production. In other words,

When utility-maximizing consumers and profit-maximizing sellers operate in a perfectly competitive market, the long-run market equilibrium is completely efficient. Resources are allocated to consumers who most value them (allocative efficiency) and goods are produced at the lowest cost (productive efficiency).

Cost structures and long-run equilibrium price

As firms enter and exit this market, the supply curve adjusts. These shifts in supply change the short-run equilibrium price, which further affects the profit-maximizing quantity supplied by the existing firms. After all of these dynamic adjustments have taken place, and all firms have fully responded to the existing market conditions, the market will have reached its long-run equilibrium point.

Consider an exogenous increase in demand as depicted in Figure 4 below with the following three panels:

- Panel (a) shows an increasing cost industry

- Panel (b) shows a decreasing cost industry

- Panel (c) shows a constant cost industry

If we are in an increasing cost industry, newly entering firms shift the market supply in a relatively small way, relative to the change in quantity supplied by the existing firms. This means that the new equilibrium price is higher. If instead, we are in a decreasing cost industry, then the newly entering firms have a relatively large impact on the market supply (relative to the change in quantity supplied). This means that the new equilibrium price is lower.

Alternatively, if we are in a constant cost industry, then both processes have an equal impact and the new equilibrium price is exactly the same. Regardless of the industry cost structure (increasing, decreasing, or constant), the new equilibrium point together with the original equilibrium carve out the long-run supply curve for this industry.

Perfect Competition - Key takeaways

- The defining characteristics of perfect competition are a large number of buyers and sellers, an identical product, price-taking behavior, and no barriers to entry or exit.

- Firms face horizontal demand at the market price and

- The profit maximization rule is which can be derived from

- The shutdown rule is

- Profit is

- Short-run equilibrium is allocatively efficient, and firms can earn positive or negative economic profits.

- Long-run equilibrium is both productively and allocatively efficient.

- Firms earn a normal profit in long-run equilibrium.

- The long-run supply curve and equilibrium price depend on whether we are in an increasing cost industry, decreasing cost industry, or a constant cost industry.

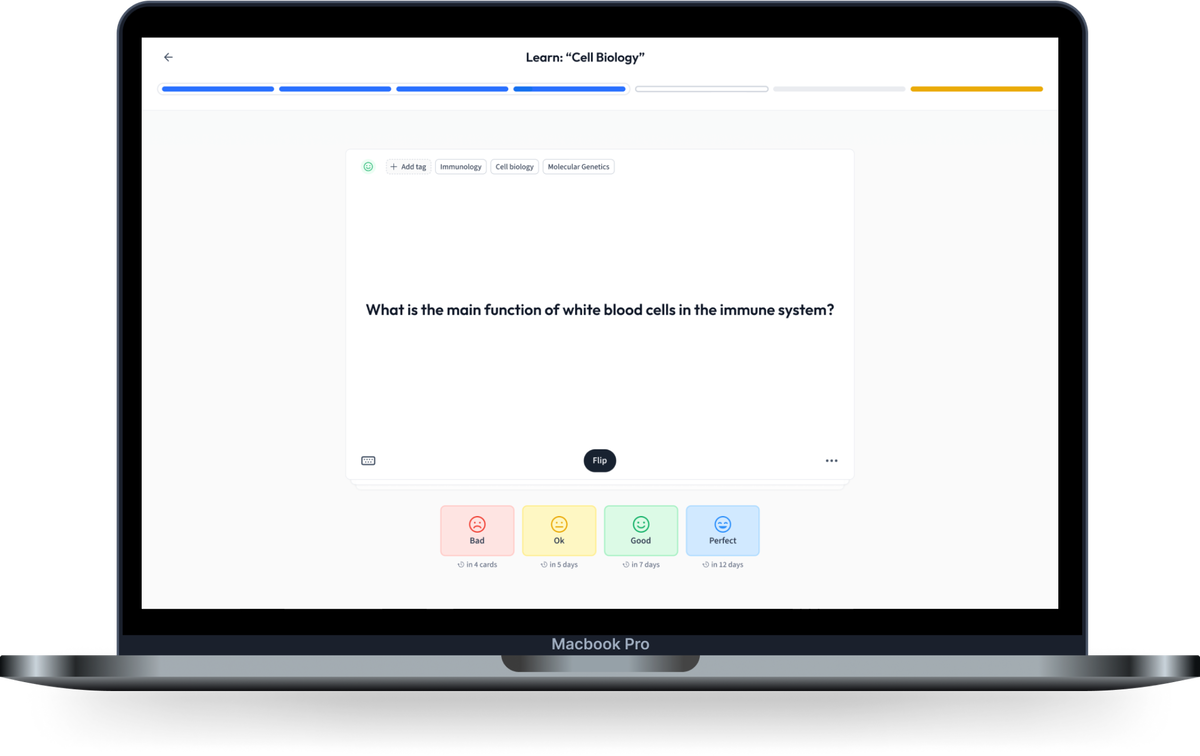

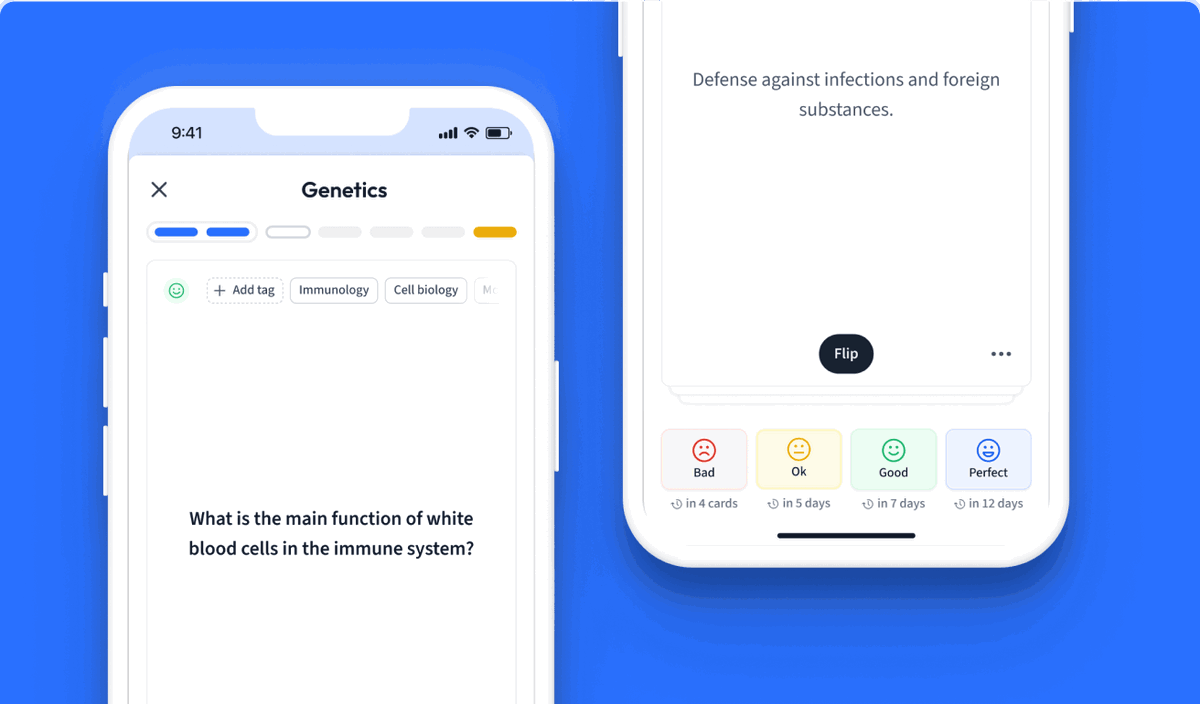

Learn with 162 Perfect Competition flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Perfect Competition

What is perfect competition?

Perfect competition is a market structure in which there is a large number of firms and consumers.

Why is a monopoly not perfect competition?

Monopoly is not perfect competition because in a monopoly there is only one seller as opposed to many sellers as in perfect competition.

What are examples of perfect competition?

Commodity markets which sell products such as agricultural produce are examples of perfect competition.

Are all markets perfectly competitive?

No, there are no markets that are perfectly competitive as this is a theoretical benchmark.

What are the characteristics of perfect competition?

The characteristics of perfect competition are:

- A large number of buyers and sellers

- Identical products

- No market power

- No barriers to entry or exit

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more