Understanding the Corporation Concept

In the world of business studies, you might frequently encounter the term Corporation. But, what exactly does this term mean?Exploring the Meaning of Corporation

A corporation is a legal entity that is separate from its owners. It can conduct business, enter into contracts, and own property in its own name, just like an individual. It’s owned by shareholders who benefit from limited liability. That means if the corporation has debts or legal liabilities, the shareholders' personal assets are typically not at risk.

Let's take an example, let's consider a popular corporation, ‘Apple Inc’. This company is an independent legal entity, distinguished from its founders and shareholders. Any legal actions taken against Apple Inc. are directed to the company as a separate entity and not to any specific individuals.

- Advantages of a Corporation: The shareholders have limited liability, meaning they are only liable up to the amount they invested in the business. The corporation has a continuous existence, meaning it does not dissolve when shareholders change. Corporations are also able to raise capital easily through the sale of stocks and bonds.

- Disadvantages of a Corporation: Formation can be a complex and expensive process. Corporations are subject to double taxation, as both the company's income and the dividends paid to shareholders are taxed. There are also more regulatory controls on corporations.

Corporation Entity: The Basics

A corporation, by legal definition, is an entity that is empowered with the legal rights which are typically only reserved for individuals. These legal rights, given by the state, include the ability to enter contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes. The corporation is, in fact, considered a legal "person".| Characteristic | Description |

| Limited Liability | Shareholders' liability is limited to their investment in the corporation. |

| Transferability of Shares | Shares can be bought and sold without affecting the corporation's existence or operations. |

| Perpetual Existence | The corporation continues to exist even if all owners or shareholders leave or pass away. |

| Distinct Legal Personality | The corporation is considered a 'legal person' separate from its shareholders. |

The main reason people form corporations is to avoid personal liability for the debts of the business. A shareholder cannot lose more than the price of his or her stock, while the directors and officers are not personally responsible for debts and other obligations incurred by the corporation, unless they have personally guaranteed them.

Roles and Duties of a Corporation

Corporations, as independent legal entities, play several pivotal roles in the overall functioning of our economy and society. To understand these roles and duties, one must look at different aspects, including its fundamental responsibilities and its relation with the government.Fundamental Responsibilities of a Corporation

The core responsibility of any corporation lies in achieving its primary goal: the maximization of shareholders' wealth. However, the means to accomplish this objective should be ethical, adhering to laws and regulations. Profitability should not supersede the corporation's accountability towards society. Although corporations have one objective, it would be a mistake to assume that they have only one responsibility. Corporations have responsibilities to several groups, called 'stakeholders'. The responsibilities to the stakeholders are quite diverse:- Profitability for shareholders: The primary obligation of a corporation to its shareholders is to be profitable. This doesn't mean making a profit at any cost, but rather it means operating in a manner that increases the value of the shares.

- Fair Treatment: Corporations should treat their employees with fairness. This includes providing a safe work environment, fair pay, and reasonable working conditions.

- Development and growth opportunities: Corporations should provide opportunities for employees' career development and growth.

- Environmentally friendly practices: Corporations have a role in making sure their operations are not harmful to the environment.

- Community support: Corporations should take part in community efforts and philanthropy.

The Role of Corporation in Government

Corporations interact with government in multiple ways. They can impact government policies, contribute to the economy, and ensure compliance with laws and regulations. Corporations are heavily involved in a nation's financial growth. Their economic influence partly arises from:- Tax Revenue: Corporations contribute significantly to a nation’s tax revenue, which is crucial for maintaining public services and infrastructure.

- Employment: Large corporations can become the primary employers in certain regions, thereby having a profound impact on the local economy.

- Regulatory compliance: Corporations must conform to government-set industry standards and health, safety, and environmental regulations. For instance, manufacturing businesses need to meet safety standards and demonstrate environmental stewardship.

- Policymaking and lobbying: Corporations often engage with governments during the policymaking process, providing information and lobbying for favourable regulatory circumstances.

An example of this is the interaction between tech corporations and governments around data regulation, privacy, and tax issues.

Financial Matters in a Corporation

As you delve deeper into the world of business studies, it's crucial to understand how financial factors affect a corporation. Your journey to understand this begins with two major areas: corporation accounting and corporation tax.Essentials of Corporation Accounting

Corporation Accounting, also known as corporate accounting, is the field of accounting that deals with financial statements, tax matters, and records of corporations. To comprehend the specifics of this field, you need to understand the core concepts underlying it. The balance sheet, income statement, and cash flow statement are the three primary financial statements generated in the corporation accounting process. These documents tell you about the financial health, profitability, and cash flows of the company.- Balance Sheet: This provides a snapshot of a corporation's financial position at a particular moment. It lists assets, liabilities, and shareholders' equity. The key equation for a balance sheet is: \( \text{Assets} = \text{Liabilities} + \text{Shareholder's Equity} \)

- Income Statement: Also known as the profit and loss statement, it shows the corporation's revenue and expenses over a period, culminating in net income or net loss. The fundmental structure of an income statement is: \( \text{Net Income} = \text{Revenues} - \text{Expenses} \)

- Cash Flow Statement: This provides information about the corporation's cash inflows and outflows during a period. It helps determine whether the corporation has enough cash to pay its expenses. It divides cash flows into operating, investing, and financing activities.

In the field of corporation accounting, Depreciation and Amortization are two key terms. Depreciation is the method of spreading out the cost of a tangible asset over its useful life. Amortization, similarly, is the process of spreading out the cost of an intangible asset over its expected useful life.

An Insight into Corporation Tax

Corporation Tax, sometimes referred to as Corporate Tax, is a tax imposed on the profits of a corporation. Its understanding requires a comprehensive look into various aspects, such as taxable income, tax rates, and tax planning. The taxable income of a corporation is its gross income minus deductible expenses. Gross income includes business income, gains on sales of assets, rents, royalties, and dividend and interest income.- Business Income: This includes any income from the sales of goods or services.

- Deductible Expenses: These are costs associated with earning income and running the business. Examples are wages and salaries, expenses for raw materials, rental costs, and interest on loans.

Tax Planning forms a crucial part of corporate financing. It involves strategies to minimise the corporation's tax liability, such as claiming all eligible deductions and credits, making smart investment decisions, selection of legal form of the organisation, timing of income and deductions, etc.

Differentiating Corporation from Other Business Types

The world of business is vast and diverse. One of the most common confusions among beginners is understanding the difference between a corporation and other business types. To set the record straight, here's an in-depth look into distinguishing characteristics and benefits that a corporation possesses compared to other business forms.Corporation vs Company: Highlights of Differences

A common misconception is that a 'Corporation' and a 'Company' are interchangeable terms. In reality, they represent different structures in the business landscape and exhibit several distinct characteristics. The term 'Company' is a broader concept and includes various types of businesses, while 'Corporation' refers to a specific type of company that has a separate legal entity in itself. Let's delve deep into the key areas that allow us to differentiate them:Legal Entity: A principal difference lies in the legal entity status. A corporation, by law, is considered a separate legal entity distinct from its owners. It can own property, enter contracts, incur liabilities independently of its owners or shareholders. On the other hand, not all types of companies enjoy this feature.

- Ownership: Corporations and companies differ on the basis of ownership. In a corporation, ownership is based on shareholdings. These shares can be transferred easily and freely without affecting the corporation's existence or structure. In contrast, the ownership structure in a company depends on its type, such as in a sole proprietorship, where one person owns the entire company.

- Liability: In a corporation, shareholders have limited liability, meaning they are liable only to the extent of their investment in the corporation. Their personal assets are protected. However, in some types of companies, such as sole proprietorships and partnerships, owners could bear unlimited liability, i.e., their personal assets may be at risk in case of business debt.

- Management: In corporations, there is a separation of ownership and management. Shareholders own the corporation, but the Board of Directors, elected by the shareholders, oversees the management of the affairs. On the contrary, in many types of companies, owners directly manage business operations.

Corporation Advantages - How They Stand Out

Corporations, being a unique form of business structure, come with their own set of advantages that make them stand out from other business types. Here are some noteworthy benefits:Limited Liability: This is one of the most significant advantages of a corporation. Shareholders of a corporation have limited liability protection. This means they are liable for the corporation's debt only to the extent of their investment. Shareholders' personal assets are not at risk in most events.

- Durability: Corporations hold perpetual existence. This means the corporation continues to exist and do business, irrespective of changes in ownership or management.

- Capital Raising: As corporations issue shares of stock, they uniquely qualify for raising capital both through equity (issuing common or preferred stock) and debt (issuing bonds). This feature makes it easier for corporations to attract investment.

- Transferability of Shares: Stocks or shares representing ownership in a corporation are freely transferable. This provides liquidity to investors and does not affect the continued operation of business.

- Professional Management: In a corporation, there's a clear separation between ownership and management. The Board of Directors, chosen by the shareholders, manages the corporation. This separation accommodates professional management and constructive oversight, often leading to better efficiency and productivity.

Breaking Down the Types of Corporation

The world of corporations is diverse and complex, with a plethora of types and classifications. To make this elucidating, you must understand each type's distinct characteristics, what sets them apart, and how these variations impact their business operations.Examining Different Types of Corporation

When several people decide to start a business together, they have the option to form a corporation. Based on the peculiarities of formation, ownership, liability, and taxation, corporations can be classified into several different types. Let's dive deeper into the key types of corporations and the distinguishing points that set them apart:- C Corporation: This is the standard corporation form, and most publicly listed companies are C Corporations. They are separate legal entities with their own rights and liabilities. Shareholders in a C Corporation have limited liability, and this corporation can have an unlimited number of shareholders.

- S Corporation: An S Corporation is designed for smaller businesses. It is similar to a C Corporation but with some major differences in taxation. S Corporations avoid double taxation common in C Corporations as their profits, losses, deductions, and tax credits get passed directly to shareholders.

- Non-Profit Corporation: These corporations are formed for charitable, religious, educational, or scientific purposes, with earnings reinvested into the corporation's cause. They are exempt from federal income tax, and donations to them can be tax-deductible.

- Professional Corporation: Created for licensed professionals like doctors, lawyers, or accountants, professional corporations limit owners’ personal liability for malpractice of their associates.

| Type of Corporation | Ownership | Taxation | Purpose |

| C Corporation | Unlimited number of shareholders | Double taxation — corporation's profits are taxed at the corporate level and shareholders' dividends at individual level | For-profit |

| S Corporation | Up to 100 shareholders, who must be U.S. citizens or permanent residents | Tax advantages — avoids double taxation | For-profit |

| Non-Profit Corporation | Controlled by board of directors | Exempt from federal income tax | Charitable, religious, educational, or scientific purposes |

| Professional Corporation | Licensed professionals | Typically taxed as a C corporation, but can elect to be taxed as an S corporation | Professional services |

Corporation Example for Enhanced Understanding

Let's consider an example to aid your understanding of the practicality and application of a corporation structure:Consider a group of entrepreneurs who develop an innovative technology product. They decide to form a business to manufacture and sell this product. They choose to establish a C Corporation, which enables them to seek investment capital from a large number of shareholders and provides the shareholders with the safeguard of limited liability.

Now, let's consider a different scenario where a doctor and a dentist decide to start a joint practice together. They form a Professional Corporation to provide their services to the public. As licensed professionals, they can maintain their independent professional practices within the corporation, and their personal liability for each other's malpractice is limited.

Corporation - Key takeaways

- Corporations are independent legal entities with key roles in the global economy. They have responsibilities towards shareholders, employees, and society.

- The core responsibility of a corporation is to maximize shareholders' wealth ethically and within legal constraints.

- Corporation accounting consists of managing financial statements, tax matters, and records of corporations. Core concepts include depreciation and amortization, and three key documents: the balance sheet, income statement, and cash flow statement.

- Corporation Tax, or Corporate Tax, is a tax imposed on the profits of a corporation. It involves various aspects such as taxable income, tax rates, and tax planning.

- Corporations and companies are distinguished by legal entity status, ownership, liability, and management. Corporations offer significant advantages like limited liability, durability, capital raising, transferability of shares, and professional management.

- Different types of corporations exist, categorized based on peculiarities of formation, ownership, liability, and taxation.

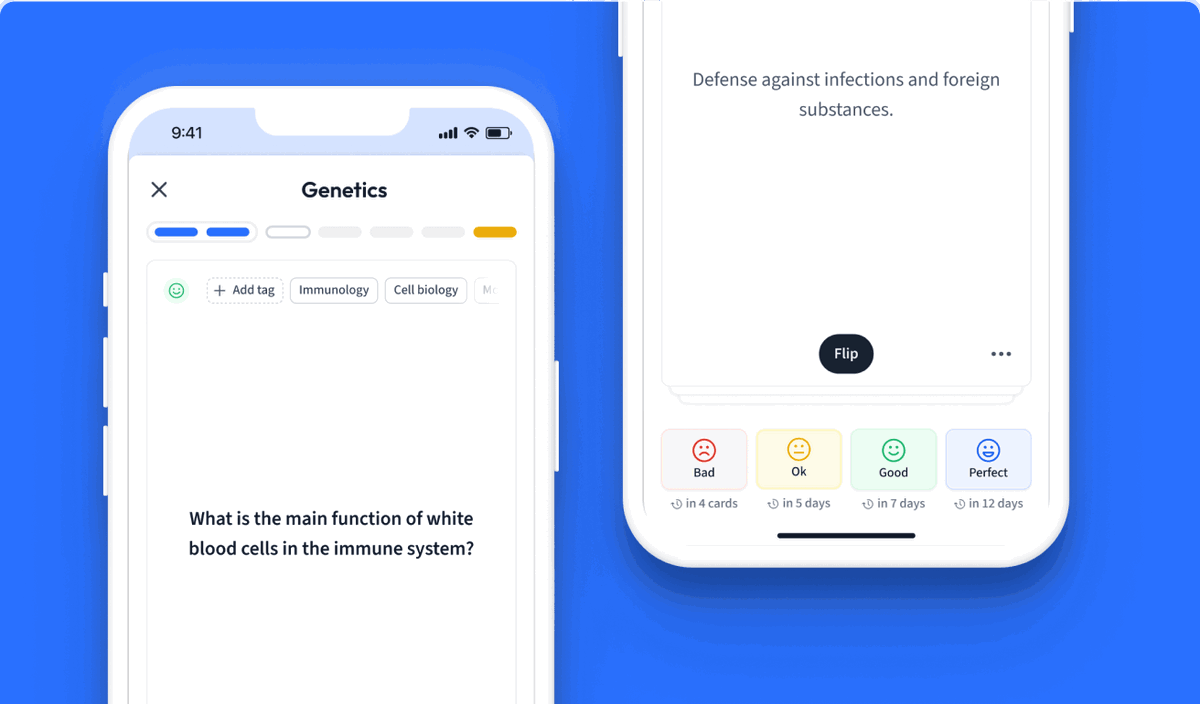

Learn with 15 Corporation flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Corporation

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more