Understanding Asset Backed Securities for Business Studies

Business studies can be overwhelming at times due to the plethora of financial instruments that come into play. An important but sometimes not thoroughly understood financial instrument that you would come across in your business studies is the Asset-Backed Securities (ABS). Understanding Asset-Backed Securities is fundamental for getting real-life insights into financial markets.

What Are Asset Backed Securities: A Thorough Look into their Nature and Function

Asset Backed Securities (ABS) are financial securities backed by a loan, lease or receivables against assets other than real estate and mortgage-backed securities. With ABS, income from various assets is bundled together and sold to investors in the form of securities. This process is known as securitisation. The asset pool can contain any income-producing asset, such as auto and credit card loans, education or business loans, among others.

In essence, Asset backed securities work as a bridge, making illiquid assets marketable to investors. This is a crucial step in financial markets that facilitates lending and borrowing by creating tradable securities out of a bundle of loans that could otherwise stay on the lender's balance sheet. This method of utilising the underlying assets enhances liquidity and efficiency in financial markets.

Simplifying the Concept: Asset Backed Securities Primer

The concept of Asset Backed Securities might seem complex at first, but you can understand its underlying mechanism better with a straightforward example.

Imagine a Financial Institution A has a bundle of car loans. These are simply loans given out to individuals who need to finance a car, and are yet to be repaid in full. Financial institution A, instead of waiting for the borrowers to repay these individual loans, decides to pool them together and sell them to a trust. The trust then issues asset-backed securities to investors using these car loans as collateral. Investors buy these ABS with the hope of gaining returns when the car loans are gradually repaid. Hence, Financial Institution A gets immediate liquidity instead of waiting several years for the loans to be paid back, while investors get an investment product with scheduled income payments.

Crucial Characteristics of Asset Backed Securities

- Risk and Return:

- Liquidity:

- Diverse payment structure:

Like most other financial instruments, Asset Backed Securities come with a certain degree of risk. However, the risk level varies depending on the underlying assets that back the securities. This also influences the possible returns.

ABS provides liquidity to financial institutions by allowing them to free up capital tied in loans.

ABS allows for diversity in the payment structure. The interest and principal payments from the underlying assets can be structured in multiple ways to suit the particular desires of the investors.

It is also important for you to note that the creditworthiness of ABS is often determined by Credit Rating Agencies, who assess the risk based on the quality of the underlying collateral, the likelihood of default, and the sufficiency of the protection provided by the structure of the issue amongst others.

How Asset Backed Securities Relate to Student Loans

In the field of Finance, you'll find that Asset Backed Securities (ABS) bridge the gap between lenders with excess capital and borrowers in need of funds. This relationship is particularly evident in the student loans sector. Through a mechanism known as securitisation, lenders of student loans, such as banks or other financial institutions, bundle together a group of student loans and sell these loan packages as Asset Backed Securities.

An Insight to Student Loan Asset Backed Securities

Student Loan Asset Backed Securities (SLABS) uses student loans as the underlying asset. In essence, this means that the income generated from the payback of these student loans forms an integral part of the income for investors of SLABS.

This concept has burgeoned over the years with increasing significance. As a key topic within Business Studies, understanding SLABS helps you connect the dots between education financing and asset-backed securities.

| Underlying Asset | Uses |

| Student Loans | SLABS allows financial institutions to shift risk and unlock capital tied to student loans. |

The whole securitisation process begins with creating a pool of student loans, which are later transferred from the original lender to a separate legal entity, termed Special Purpose Vehicle (SPV). The SPV then issues securities that are purchased by investors. It’s important to note that these securities are coupled with various tranches, each carrying designated risks and returns.

If you are wondering how to evaluate the expected risks and returns associated with these tranches, it is predominantly done using credit enhancement techniques, which essentially aim to lower the credit risk associated with the securities. Credit tranching, for instance, partitions the credit risk into distinct levels based on the quality of loans, with senior tranches being repaid first and subordinate tranches later. The formula that would be considered in credit tranching would look something like this:

\[ \text{{Subordination Level}} = \frac{{\text{{Subordinate Tranche Balance}}}}{{\text{{Total Tranche Balances}}}} \]Impact of Student Loan Asset Backed Securities on Education Financing

Understanding the fundamental relationship between Asset Backed Securities and student loans wouldn't be entirely complete without remarking on the impact SLABS have on education financing. It's a fascinating area where finance directly influences real-world issues such as access to education.

Initially, one might wonder how essentially financial constructs like Asset Backed Securities, in particular SLABS, affect students and the education industry. Well, by issuing SLABS, lenders can liquefy their asset portfolio tied up in student loans, thus acquiring a greater ability to provide more loans. This increased liquidity can lead to enhanced availability of student loans, thereby increasing accessibility to higher education for more students.

This does not come without risks - the quality of the student loans backing the securities impacts the performance of SLABS. Due to the nature of the loans on the backing end, factors such as graduation rates, employability rates after graduation, and changes in government policies regarding student loans can all affect the creditworthiness of SLABS. Therefore, as an investor in SLABS, these factors have to be into account as they could significantly impact the return on investment.

SLABS have indeed revolutionised education financing and continue to do so by allowing more students to access higher education. However, the potential risks associated should not be overlooked. A thorough understanding of the dynamics of SLABS and the associated risks is beneficial for both the stakeholders in the education sector and prospective investors.

Exploring the Different Types of Asset Backed Securities

In your exploration of Asset Backed Securities (ABS), you'll come across different types. Each type is distinct, with its own unique set of underlying assets and operational mechanisms. By diving into these details and examples, you will gain a more comprehensive understanding of how ABS function within various sectors.

A Breakdown of Common Types of Asset Backed Securities

In the vast domain of Asset Backed Securities, a few major types consistently stand out due to their widespread occurrence and high relevance. Here's a detailed rundown of those types:

- Home Equity Loan ABS:

- Automobile Loan ABS:

- Credit Card Receivables ABS:

- Student Loan ABS:

- Definition of Asset Backed Securities (ABS): Financial products backed by a loan, lease, or receivables against assets apart from real estate and mortgage-backed securities.

- Characteristics of Asset Backed Securities: They carry a degree of risk dependent on the underlying assets, allow for greater liquidity, and have diverse payment structures.

- Student Loan Asset Backed Securities (SLABS): ABS that use student loans as the underlying asset. These securities have impacted education financing by increasing the availability of student loans.

- Different Types of Asset Backed Securities: Include Home Equity Loan ABS, Automobile Loan ABS, Credit Card Receivables ABS, and Student Loan ABS.

- Causes and Effects of Asset Backed Securities: The inception of ABS is attributed to the need for risk mitigation, improved liquidity management, and diversified investment. The consequences can include improved financial position for institutions and an injection of capital into the economic system.

These are securities backed by home equity loans, which are essentially second mortgages that homeowners take on their property. A subcategory within this is Home Equity Lines of Credit (HELOC), which act like a credit card limit set against the equity on the homeowner’s property. The fluctuating interest rates in HELOC ABS make them different from standard home equity loan ABS.

Automobile Loan ABS are backed by loans on vehicles. In this case, the underlying assets are diverse, from brand new cars to used ones, and even to commercial vehicles. The performance of auto loan ABS depends on various factors, including car depreciation rates, loan terms, and creditworthiness of borrowers.

Credit Card Receivables ABS are slightly more complex in nature because unlike an auto loan or a mortgage, there's no fixed term or repayment schedule with credit cards. These ABS are collateralised by the future payment on the credit card debt.

As discussed in detail previously, these ABS are backed by student loans. Given the rising costs of tuition, the volume of Student Loan ABS has seen consistent growth over the years. However, their performance can fluctuate significantly based on changes in the job market and federal education policies.

| Type of ABS | Underlying Asset | Features |

| Home Equity Loan ABS | Home equity loans, HELOCs | Interest rates may fluctuate with HELOCs. |

| Automobile Loan ABS | Automobile loans | Species diversity, depends on depreciation rates and creditworthiness of borrowers. |

| Credit Card Receivables ABS | Credit card debt | No fixed term or repayment schedule with credit cards. |

| Student Loan ABS | Student loans | Performance can fluctuate significantly based on job market and federal policies. |

Providing Real-Life: Asset Backed Securities Example

To consolidate this understanding of different types of ABS, let's go over a practical example.

Consider an Automobile Loan ABS scenario. Take a financial institution having a large number of auto loans on its books. Each loan is earning interest, but if any of the borrowers default, there is always the risk of loss. The financial institution might decide to transfer this risk by creating an ABS. It pools together thousands of auto loans and sells it off as an ABS to a Special Purpose Vehicle (SPV). The SPV then issues bonds to investors backed by these auto loans, whereby investors get paid as the original borrowers start making their loan repayments. In this manner, the financial institution moves the loans off its books, reducing its risk exposure, and also gets access to instant capital that was otherwise locked. The investors, on the other hand, acquire an investment opportunity carrying systematic risk with returns in the form of regular loan repayments.

It is crucial to remember that the actual ABS procedures can be more complex with numerous nuanced aspects depending on the nature of underlying assets, the structuring of the security, and the legal and financial environment.

The understanding of Asset Backed Securities can be quite a task, but with each bit of information and example, you'll soon find yourself navigating through ABS with ease. Keep in mind that at its core, ABS is a unique financial instrument benefitting multiple parties, from the initial lender to the investors and the borrowers.

The Causes and Effects of Asset Backed Securities on Corporate Finance

In the realm of corporate finance, Asset Backed Securities (ABS) act as pivotal financial instruments, shaping the course of lending, borrowing, investing, and risk management. To gain a thorough comprehension of ABS, it is essential to delve into the central causes and consequences of their existence and operation.

Delving into the Causes of Asset Backed Securities

The inception and proliferation of Asset Backed Securities in corporate finance are largely attributed to a series of interconnected causes. To decipher these causes, it is beneficial to examine the motivations and challenges that lie at the heart of lending and borrowing institutions.

Risk Mitigation: One of the paramount causes for the existence of ABS is the need for lenders, such as banks and other financial institutions, to mitigate the risk associated with their loan portfolios. By pooling loans together and selling them off as securities to investors, lenders can effectively transfer some of their credit risk to others.

Liquidity Management: An additional vital cause for the emergence of ABS lies in liquidity management. Institutions that initially provide loans usually need to wait for a significant time period to recoup their capital as borrowers repay their loans over time. This ties up the lending institution's capital, constraining them from making new loans. ABS allow these lending institutions to turn these long-term assets into immediate cash, thus enhancing their liquidity position.

Diversification of Investment: The creation of ABS also fosters a diversified investment environment. By dividing the underlying pool of assets into tranches based on risk levels and yields, ABS allows investors to choose securities that align with their individual risk appetites and return expectations.

| Cause | Description |

| Risk Mitigation | Lenders use ABS to pass on credit risk associated with their loan portfolios. |

| Liquidity Management | ABS allow lending institutions to turn long-term assets into instant cash. |

| Diversification of Investment | ABS offer various risk and return profiles for investors to choose from. |

| Effect | Description |

| Improved Financial Position | Lending institutions can strengthen their financial position by using ABS. |

| Injection of Capital | ABS provide immediate cash for lending institutions, boosting their capital. |

| Modification in Investor Behavior | ABS provide new investment options, altering investing patterns and capital allocation. |

| Increased Market Efficiency | ABS enhance market efficiency by allowing for risk transfer and capital allocation. |

| Exposure to Systematic Risk | ABS can lead to widespread financial damage due to their exposure to systematic risk. |

The causes and effects of Asset Backed Securities are multifaceted, each influencing distinct aspects of corporate finance. As ABS continue to advance and diversify, their potential impacts will continue to reshape the financial landscape in unforeseen ways.

Asset Backed Securities - Key takeaways

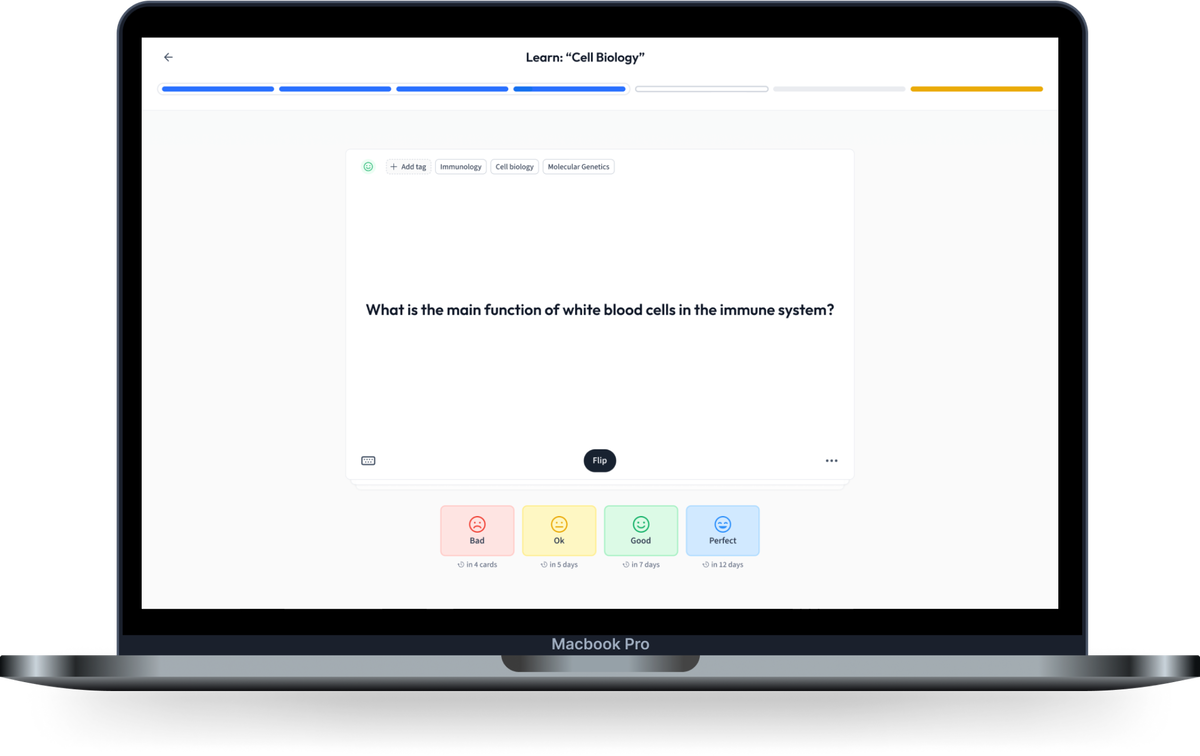

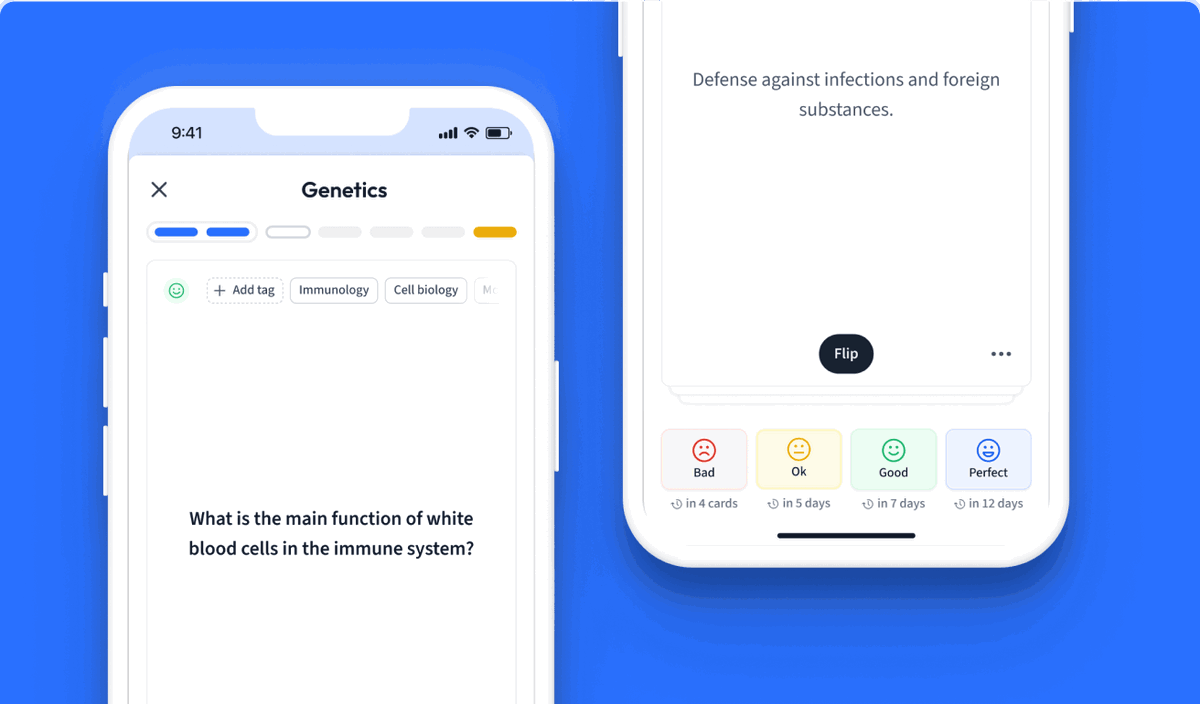

Learn with 12 Asset Backed Securities flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Asset Backed Securities

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more