Understanding APR in Business Studies

In your journey through Business Studies, one fundamental concept you'll come across is APR, or Annual Percentage Rate. This term, although it might look intimidating at first, is actually quite straightforward once you understand its meaning and application in different contexts.Definition: What is APR?

The term APR stands for Annual Percentage Rate. It is a yearly representation of the interest you are charged for borrowing, or what you earn through an investment. In simple terms, this is the actual yearly cost of funds over the term of a loan or investment.

- the principal amount (the initial amount of money borrowed or invested),

- the interest rate,

- the compounding rate,

- and certain fees or additional costs associated with the borrowing or investment.

Decoding APR: APR explained in simple terms

Hope the mathematical expression of the formula above hasn't intimidated you. If it has, let's break down APR into simpler terms. In essence, the APR is the real cost of a loan or an investment on a yearly basis. When you take out a loan or make an investment, the lender or the investment platform will provide the APR. This rate includes not just the interest on the money you borrow or invest, but also any fees or additional costs associated with borrowing or investment across an entire year.Real-life Examples of APR usage in corporate finance

To further illustrate this concept, let's consider a table representing some real-world examples:

| Type of Loan | Principal Amount | Interest (Annual) | Fees (Annual) | APR |

| Business Loan | £10,000 | £1,400 | £100 | 15% |

| Home Loan | £200,000 | £20,000 | £2,000 | 11% |

In business, understanding APR is essential for making cost-effective decisions. When comparing loan options, lower APRs tend to be better as they represent cheaper loans. When looking at investment opportunities, higher APRs are typically more desirable because they indicate higher returns. Knowing how to calculate and interpret APR can help make more informed decisions about loans and investments. It aids in identifying potential costs and returns, making it a valuable tool in the field of finance.

APR vs Interest Rates and APY: An in-depth comparison

One crucial aspect investors and borrowers often face is understanding the difference and applications of APR, interest rates, and APY. While these terms are often used interchangeably, they each have unique meanings in the context of business finance.Grasping the difference: APR vs interest rate

The interest rate is fundamentally the cost of borrowing the principal loan amount. It's typically quoted as a percentage and does not take into account any extra fees or charges that may come with the loan. The most common type of interest rate is the annual interest rate, which is spread over a year. In LaTeX, the formula for calculating interest is: \[ Interest = Principal Amount * Interest Rate * Time \] On the other hand, APR (Annual Percentage Rate) represents the total yearly cost of a loan to a borrower, including fees and other costs. APR is a more comprehensive measure of borrowing costs and provides borrowers with a more accurate view of the total costs associated.Intersection and Divergence: APR vs APY

Both APR and APY (Annual Percentage Yield) represent rates of interest. However, they differ in how they account for the effects of compounding. APR is based on simple interest - it compounds only once per year. In comparison, APY takes into account compound interest, which is the interest earned on interest, thus, providing a more accurate annual yield on an investment or loan. The formula to calculate APY in LaTeX is: \[ APY = (1 + \frac{r}{n})^{nt} - 1 \] where:- \( r \) : annual interest rate

- \( n \) : number of compounding periods per year

- \( t \) : time the money is invested for in years

Learning from examples: APR, interest rate and APY compared

To pull all these concepts together, let's consider a practical scenario. Assume you take a loan of £10,000 with an advertised interest rate of 5% and a one-time fee of £500. The annual interest would be: \[ Interest = Principal Amount * Interest Rate * Time = £10,000 * 5% * 1 = £500 \] However, the APR, considering the one-time fee, would be higher: \[ APR= \frac {Total Interest Paid + Fees}{Principal Amount} * 100 = \frac {£500 + £500}{£10,000} * 100 = 10% \] Let’s not forget about the APY. If you were to compound the interest quarterly (four times a year), your APY would be: \[ APY = (1 + \frac{5\%}{4})^{4*1} - 1 = 5.095% \] This example reflects how APR and APY, despite being based on the same base interest rate, can yield different amounts, owing to the costs associated and compound interest. It also highlights why understanding these concepts and their distinctions is a requisite for making sound and informed financial decisions.Exploring the APR Technique in Business Studies

In Business Studies, understanding APR (Annual Percentage Rate) is fundamental for students, financial analysts, and business owners. The APR technique serves as an essential tool to discern the real cost of borrowing or the actual earnings from an investment in a year.Deciphering the APR Technique: How it works?

At its core, the APR technique is about translating the costs of borrowing or the yields of an investment into a yearly percentage. This technique serves as a useful tool because it universally standardises the comparison, allowing financial agents to make informed decisions more efficiently. The APR is unique because it encompasses all significant costs associated with financial operations, including interest payments, fees, and other charges. Compared to regular interest rates, which only account for the annualized interest charged, the APR provides a broader picture of the yearly cost. Calculating the APR involves a simple formula, which can be expressed in LaTeX as: \[ APR= \frac {Total Interest Paid + Fees}{Principal Amount} * 100 \] Where:- 'Total Interest Paid' encompasses all interest expected to be paid over the term of the loan or earned from the investment,

- 'Fees' refers to any additional costs that might be charged by a financial institution, and

- 'Principal Amount' stands for the initial sum borrowed or invested.

Practical use: Application of the APR Technique in corporate finance

In the world of corporate finance, the APR technique is used extensively to make a plethora of financial decisions. Understanding and employing this technique aids businesses in comparing different loan products, investment options and ultimately improves the overall financial decision-making processes. When dealing with loans, APR helps businesses understand their borrowing costs. It enables companies to compare varied loan offers and pinpoint the one that offers the best value for money. In the realm of investments, APR aids in understanding the returns over the year. Businesses utilise the APR calculation when comparing different investment vehicles to ensure they are putting their funds in the most rewarding places.For instance, consider a business seeking to borrow £20,000 for a new project. Lender A offers a loan at 8% interest with no fees, while Lender B offers the loan at a 7% interest rate but with a £500 fee. Using the APR technique, we can determine that Lender A's APR would be 8%, while Lender B's APR, taking into account the additional fee, would stand at: \[ APR = \frac{£1,400 + £500}{£20,000} * 100 = 9.5% \] Thus, despite a lower interest rate, Lender B's loan is costlier due to the additional fee, demonstrating the practical application of the APR technique.

Repercussions of APR Changes in Corporate Finance

In corporate finance, any fluctuation in the Annual Percentage Rate (APR) can significantly affect a company's financial strategy. APR changes can have a broad impact, from changing the cost of borrowing to altering the returns from investments, and thus, it can dictate the overall financial decision-making.Understanding effects of APR Change: Key considerations

APR changes can have both direct and indirect influence on a company's financial strategies. Here are some important factors to consider:- Cost of Borrowing: When the APR on loans increases, the cost of borrowing for companies rises. This could discourage them from taking loans for projects or investments, or push them to negotiate better terms. Conversely, when the APR decreases, the cost of borrowing is reduced, making loans more attractive.

- Investment Returns: Changes in APR could also impact the returns from investments. When the APR increases, the returns from an investment may also increase, making certain investments more attractive. When the APR decreases, the returns from these investments will decrease, which may cause firms to reassess their investment strategy.

- Credit Market Conditions: APR changes can also reflect broader economic and market conditions. A high APR might indicate tighter credit market conditions, where borrowing is more costly. A lower APR may suggest that credit is more readily available. These conditions can affect a company's strategic decision-making around borrowing and investing.

- Business Strategy: Changes in APR can also affect a company's overall business strategy. For instance, a rise in APR might lead a business to hold off on financing initiatives or planned expenditures. Conversely, a drop in APR might encourage a business to finance expansion plans or invest in new projects in anticipation of lower borrowing costs or higher investment returns.

Real-world implications of APR changes on finance strategies

In real-world corporate finance, adjusting to APR changes can be quite a practical challenge. It calls for businesses and financial managers to take a forward-looking approach and engage in vigilant risk management. For instance, in periods of declining APR, a company might be tempted to take on more debt due to the cheaper borrowing costs. However, taking on too much debt may present risks if APR begins to rise again in the future or if the company's income can't support the debt repayment. Similarly, when a firm invests in securities with a high APR hoping for high returns, such investments can be risk-prone if the APR unexpectedly falls. It's important to manage these potential risks through diversifying investments, ensuring the business has an appropriate level of debt for its income and balance sheet, and making sure the business model is robust enough to withstand potential shifts in APR. On the lending side, banks must also take into account the rate of APR when offering loans. An unexpected dip in APR can dent profitability, while an unexpected surge in APR can unnerve borrowers. Through risk management practices including risk pricing, loan-loss provisioning and lending diversification, lenders can manage these alterations effectively.Take the example of a business that borrowed £1m when the APR was 5%. Using the formula in LaTeX to calculate the annual interest payment,: \[ Interest Payment = Principal Amount * APR = £1m * 5\% = £50,000 \] The firm planned its financial strategy around the annual interest expense of £50,000. However, if the APR rose to 7%, the annual interest payment would be: \[ Interest Payment = Principal Amount * APR = £1m * 7\% = £70,000 \] This change in APR has immediate repercussions on the firm's financial strategy, notably cash flow management and interest coverage capability. It triggers the need for the firm to reassess its financial standing and adapt accordingly.

Further Insights on APR for Business Students

Annual Percentage Rate(APR) is more than just a term in your textbook; it's a practical tool that businesses across the globe use in their financial decision-making. Varying in significance from sector to sector and company to company, understanding how APR can influence corporate finance decision-making processes is a crucial skill for budding business students.Understanding the Role of APR in Corporate Finance Decision-Making

Making sound financial decisions is key to the success and sustainability of a corporation. In this arena, APR plays a significant role by acting as a reference point that influences choices regarding borrowing, investing, and overall fiscal management. To start with, APR is integral when it comes to strategic borrowing. It helps in determining the 'actual' cost of a loan, thereby guiding businesses in choosing the most beneficial means of finance. It's not just the nominal interest rate that matters, but the annual cost, inclusive of fees and charges associated with the loan, expressed as a percentage — and that's what APR represents.APR represents the 'true' annual cost of finance, including both interest rates and other associated costs.

Remember, a lower APR doesn't always mean the 'best' deal. While APR can give you a quick and easy comparison, other factors like payment schedules, penalties, grace periods and customer service are also important to consider in decision-making.

Learning from Case Studies: Strategic Use of APR in Businesses

Examining real-life instances aids in understanding how businesses apply the APR concept strategically. Here are a couple of illustrative examples:In 2017, a telecommunications company took a £1 million loan for infrastructure development. Keeping the APR in mind while negotiating with the lender, they managed to secure a low-APR deal of just 3%. This meant they only had to pay £30,000 annually, making the loan a cost-effective choice for their expansionist strategies. For the calculations, they used the APR formula: \[ APR = \frac{Interest + Fees}{Principal} \times 100 \] Substituting known values: \[ APR = \frac{30,000}{1,000,000} \times 100 = 3% \]

In this case, the calculation for the return on investment using APR was: \[ Return = Principal \times APR = £1,000,000 \times 8\% = £80,000 \]

APR - Key takeaways

- APR (Annual Percentage Rate) represents the total yearly cost of a loan to a borrower, including fees and other costs, providing a more accurate view of the total costs associated.

- Interest rate is the cost of borrowing the principal loan amount, and does not include any extra fees or charges associated with the loan.

- APR and APY (Annual Percentage Yield) both represent interest rates; however, APR is based on simple interest while APY takes into account compound interest, providing a more accurate annual yield on investment or loan.

- Understanding, calculating and interpreting APR is essential in business for making cost-effective decisions, comparing loan options, and identifying investment opportunities.

- APR calculations are also employed in credit cards, mortgages, auto loans and in corporate finance for loans and investments, aiding businesses in comparing different loan products, investment options and making informed financial decisions.

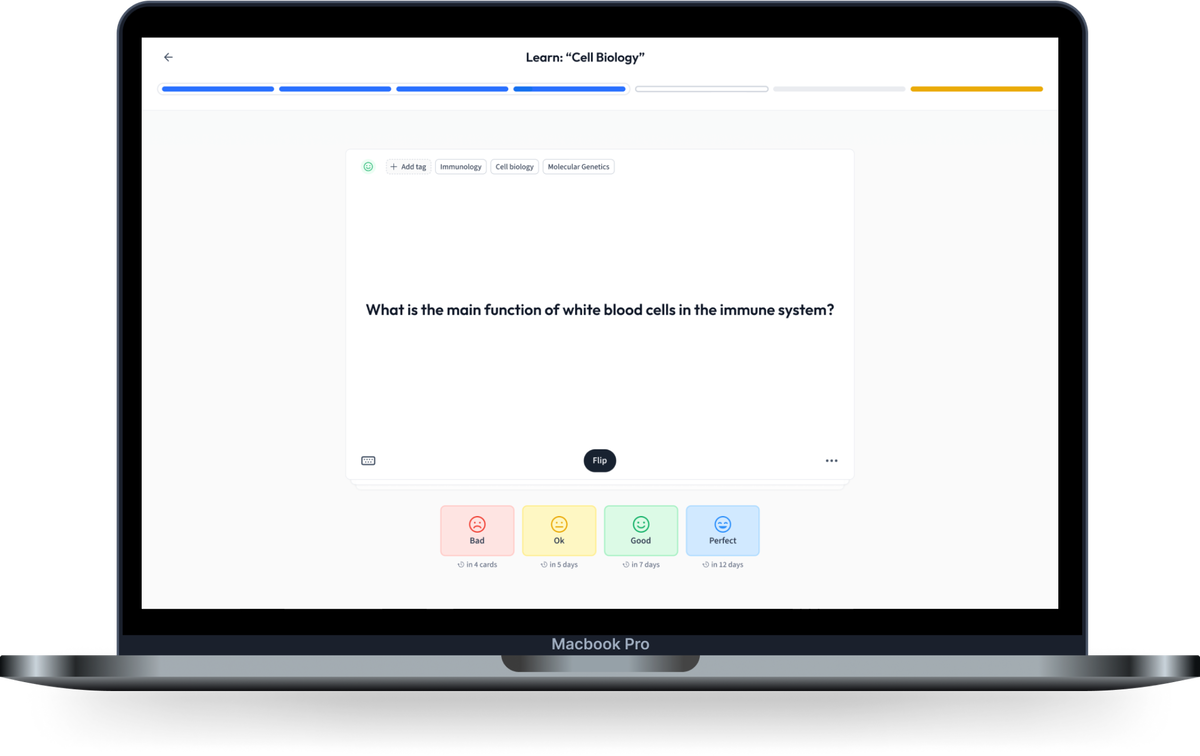

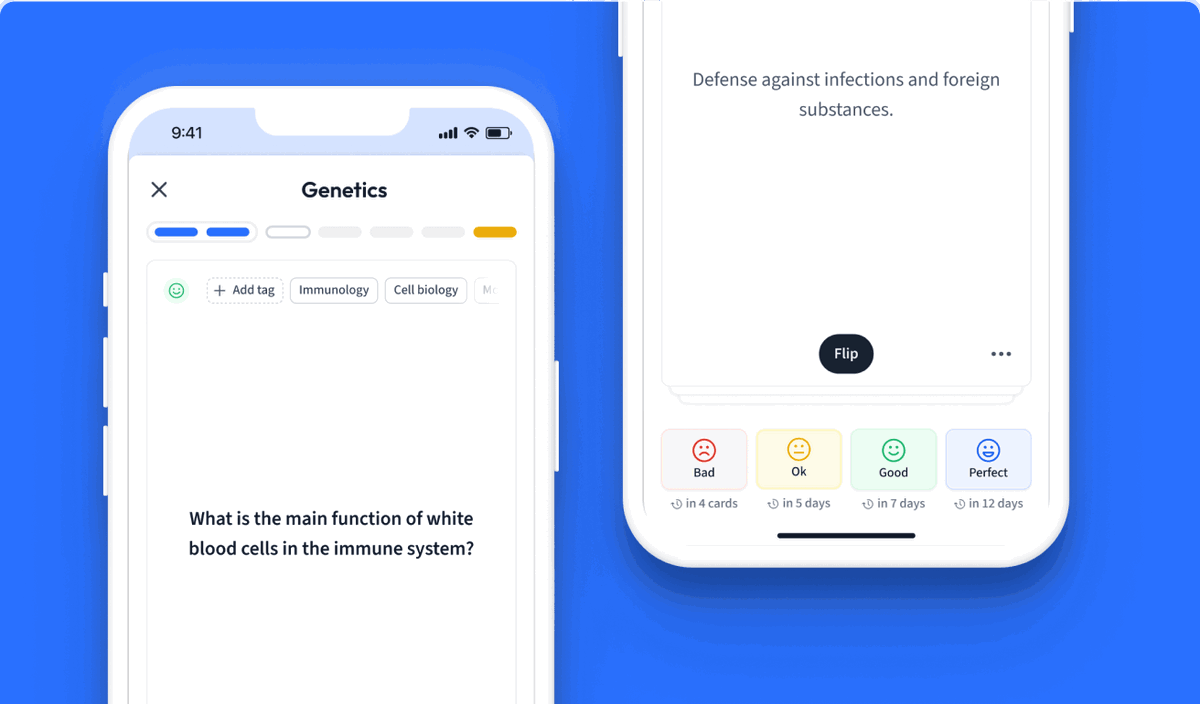

Learn with 15 APR flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about APR

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more