Due to the emergence of 3D-Computer graphic films, such as Finding Nemo (a Disney Pixar production), a competitive rise occurred in the computer graphics (CG) industry. Some of the leading companies such as DreamWorks and Pixar emerged as the most promising players in this field. During this period, Walt Disney had a few hits in 2D animation. However, due to the technological limitations of the industry, Disney was struggling to compete with the likes of Pixar.

The case is that if Walt Disney has such technological limitations, then why not acquire a company like Pixar which is skilled at 3D computer graphics? Will Pixar's freedom and creativity fit with Walt Disney's corporate governance, or will it do more harm than good? In this case study, we will investigate Walt Disney's acquisition of Pixar Animation Studios and analyse the relationship that would lead to tremendous success.

Merger of Disney and Pixar

The merger of Disney and Pixar took place in 2006 when Disney bought the Pixar company. Disney was stuck in a conundrum, still producing old-fashioned animation: the company had to innovate; otherwise, it would lose its competitive edge. On the other hand, Pixar's culture and environment were innovative and creative. Therefore, Disney saw this as the perfect opportunity for collaboration. So the two companies merged through a vertical merger.

Introduction to the case

The relationship between Disney and Pixar began in 1991 when they signed a co-production deal to create three animated films, with one of them being Toy Story released in 1995. The success of Toy Story lead to another contract in 1997, which would allow them to produce five movies together over the next ten years.

Steve Jobs, the previous CEO of Pixar, said that the Disney-Pixar merger would allow the companies to collaborate more effectively, allowing them to focus on what they do best. The merger between Disney and Pixar allowed the two companies to collaborate without any external issues. However, investors were worried that the acquisition would threaten the Disney movie culture.

Disney and Pixar merger

Disney wanted to marry the style of their previous films with the exceptional storytelling techniques of Pixar, eventually resulting in the merger.

Before the merger took place, Disney was caught in a conundrum. The company had two choices: continue making old fashioned hand-drawn movies or make a new type of Disney movie using the digital animation that was now available due to modern technology.

Disney decided to take on the new animation culture with the help of Pixar.

Since the acquisition of Pixar, Disney has implemented some of the company's animation techniques into its films and produced Frozen. This Walt Disney Pixar movie was a box office success.

Disney has been saved in many ways by the work of Pixar Animation Studios. Pixar came in and created eye-catching animated movies that were under the Disney name. However, this also posed a problem, as Disney had lost its animation culture. They were no longer catching the eye of the public with their hand-drawn movies. However, when Disney and Pixar, made films together, they were always big hits.

Pixar case study strategic management

The success of Pixar Animation can be attributed to its unique and distinctive way of creating characters and storylines. Due to the company's unique and innovative approach, they have been able to stand out from the rest of the industry.

Pixar pushed itself to invent its own unique animation techniques. They needed to find a way to attract and retain a creative group of artists that would help them become a successful company.

Aside from technology, Pixar also has a culture that values creativity and innovation. This is evidenced by the company's commitment to continuous improvement and employee education. Ed Catmull has been instrumental in developing the creative department and ensuring that everyone is on the same page. This is also evidenced by the requirement that every new employee spends ten weeks at Pixar University. This program is focused on employee preparation and development. It is also used to prepare new employees for the company's creative department.

To learn more about the internal environment of an organization, take a look at our explanations on human resource management.

Disney and Pixar merger explained

In a vertical merger, two or more companies that produce the same finished products through different supply chain functions team-up. This procedure helps in creating more synergies and cost-efficiency.

A vertical merger can help boost profitability, expand the market, and reduce costs.

For instance, when Walt Disney and Pixar merged, it was a vertical merger because the former has a specialization in distribution whilst also having a strong financial position and the latter owned one of the most innovative animation studios. These two companies were operating at different stages and were responsible for the production of great movies all around the world.

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations. When the preliminary analysis was done, it showed that the merger would be beneficial for both the companies and consumers.

The merger of Disney and Pixar is based on two alliances.

The Sales Alliance involves both the Disney and Pixar companies working together to maximize the profits from their products.

The Investment Alliance, whereby Disney and Pixar have got into an alliance in which they will share profits from the movies.

Disney and Pixar merger analysis

As a result of the merger, Disney and Pixar were able to capitalize on the potential of Pixar to create a brand-new generation of animated movies for Disney. This is also evidenced by the revenue generated from the movies made together by both Disney and Pixar.

Investors saw the potential of the computer-animated character to be used in Disney's vast network market.

The revenue achieved by Cars was about $5 million.

Walt Disney and Pixar also developed other successful films together such as Toy Story and The Incredibles.

Disney kept Pixar's management in place to ensure a smooth transition. This was also necessary for the growth of trust that would allow Steve Jobs to approve the merger. Because of the disruption that Steve had at Disney, the companies had to create a set of guidelines that would safeguard the creative culture of Pixar when acquiring the company.

To allow for the merger, the studios also needed to create a strong team of leaders who would guide the growth of the company.

To learn more about the role of organizational culture have a look at our explanation on change management.

Disney-Pixar merger synergy

Synergy refers to the combined value of two companies, which is greater than the sum of their individual parts. It is often used in the context of mergers and acquisitions (M&A).

Pixar's successful acquisition with Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360,000,000. Through the years, Disney and Pixar have been able to successfully combine forces and create a profitable business model. Over the course of 18 years, these Disney Pixar films have grossed over $7,244,256,747 worldwide. With a gross profit of $5,893,256,747.

The merger of Disney and Pixar has resulted in greater creative output. Since the acquisition, Disney-Pixar has plans to release movies twice a year as Pixar has the technology to help do so. The value and performance of the Disney and Pixar merger have been very successful because they have made large profits (e.g. Toy Story, A Bugs life, Cars). These have been produced using Pixar technology. This has also benefited Pixar as Disney has given large amounts of funding for their studios so they can create these films and use Disney's name to reach a larger audience, resulting in a synergy.

Pros and cons of the Disney-Pixar merger

One of the most successful mergers in history was the Walt Disney and Pixar merger. Although many mergers fail, they can also be successful.

In most cases, the merger brings advantages such as lower cost of production, better management team, and increased market share but they can also cause job losses and bankruptcy. Most mergers are highly risky but with the right knowledge and intuition, they can succeed. Below is the list of pros and cons of the Walt Disney and Pixar merger.

Pros of Disney-Pixar merger

The acquisition gave Walt Disney access to Pixar's technology, which was very important to them. It also provided Walt Disney with new characters that would help the company create new revenue streams.

Walt Disney also had its existing famous animated characters it could provide Pixar.

Walt Disney also gained market power by acquiring another rival company (Pixar). This would make both Walt Disney and Pixar companies have a stronger position in the market.

Walt Disney had a larger budget, which allowed Pixar to explore other opportunities that they might not have had the resources to pursue. Also, due to Walt Disney having more financial resources, they were able to start more projects and provide more security.

The acquisition would allow Steve Jobs to put Walt Disney content in the App Store, which would provide more revenue for Walt Disney and Pixar.

Walt Disney's large size gives it many advantages, such as a large human resource base, many qualified managers and a large amount of funds.

Pixar is known for its technological expertise in 3D animation. Their in-house creativity is the reason why they can create such innovative films. This was important for Disney to acquire, as they were lacking technological expertise in 3D animation.

Pixar mainly focuses on quality, and this is what makes Pixar different from other companies. They also use the bottom-up approach, where the input of their employees is highly valued.

Cons of Disney-Pixar merger

There were differences in the structure of Walt Disney and Pixar company, with Pixar artists no longer being independent , and Walt Disney now making most of the decisions.

A cultural clash between Walt Disney and Pixar took place. Since Pixar had built an environment based on its innovative culture, Pixar was worried that it would be ruined by Disney.

Conflicts between Walt Disney and Pixar occurred because of the takeover. This happened because of the hostile environment that often accompanies a takeover, which resulted in disagreements between the management and the other parties involved.

When it came to the creative freedom of Pixar, it had a fear that its creation would be restricted under Walt Disney's acquisition.

The main reason for the merger between Disney and Pixar was for Walt Disney to acquire and use the modern animation technology of Pixar to expand its reach in the market, whereas Pixar was now able to use Walt Disney's vast distribution network and funds. The acquisition gave Disney new ideas and technology, which helped the company produce more blockbuster movies. The negotiation that led to the Disney-Pixar merger was also instrumental in the company's success. This was also the reason for the huge revenue that was generated together by both companies.

Disney Pixar Merger Case Study - Key takeaways

In 1991, Walt Disney and Pixar Animation Studios established a relationship that would lead to tremendous success.

Walt Disney purchased Pixar company in 2006 for approximately $7.4 billion.

Walt Disney wanted to marry the style of their previous films with the exceptional storytelling techniques of Pixar.

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations.

Pixar's successful partnership with Walt Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, and all of them reaching a total gross of over $360 million.

The main reason for the merger between Disney and Pixar was for Walt Disney to acquire and use the modern animation technology of Pixar to expand its reach in the market, whereas Pixar was now able to use Walt Disney's vast distribution network and funds.

Sources:

The New York Times: Disney Agrees to Acquire Pixar. https://www.nytimes.com/2006/01/25/business/disney-agrees-to-acquire-pixar-in-a-74-billion-deal.html

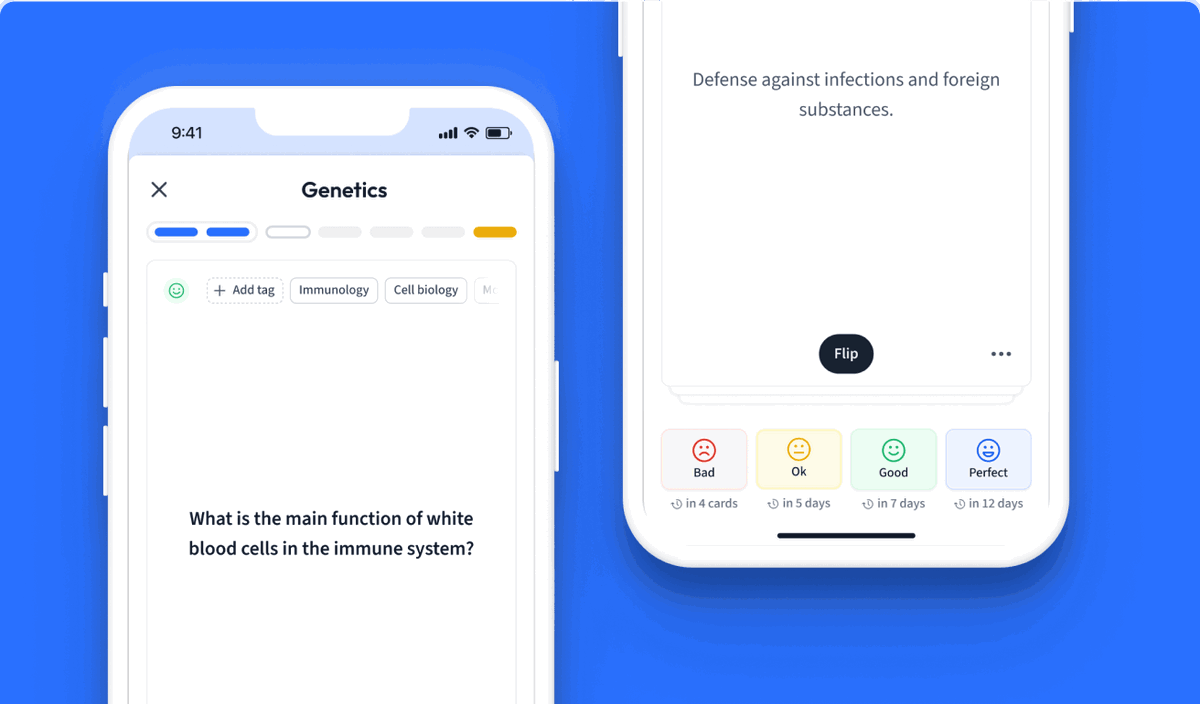

Learn with 26 Disney Pixar Merger Case Study flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Disney Pixar Merger Case Study

Why was the Disney Pixar merger a success?

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations. When the preliminary analysis was done, it showed that the merger would be beneficial for both the companies and consumers. The value and performance of the Disney and Pixar merger have been very successful because they have made large profits

What type of merger were Disney and Pixar?

Disney and Pixar merger was a vertical merger. In a vertical merger, two or more companies that produce the same finished products through different supply chain functions team up. This procedure helps in creating more synergies and cost-efficiency.

How can the synergies between Disney and Pixar be developed?

Since the acquisition, Disney-Pixar has plans to release movies twice a year as Pixar has the technology to help do so. This has also benefited Pixar as Disney has given large amounts of funding for their studios so they can create these films and use Disney's name to reach a larger audience, resulting in a synergy.

What happened when Disney bought Pixar?

Pixar's successful acquisition with Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360,000,000.

Was acquiring Pixar a good idea?

Yes, acquiring Pixar was a good idea because Pixar's successful partnership with Walt Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360 million.

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Learn more